U.S. stocks fell on Wednesday as Money Road neglected to clutch the sharp gains from the last two meetings.

The Dow Jones Modern Normal lost 42.45 focuses, or 0.14%, to 30,273.87. Prior in the day, it was down 429.88 focuses. The S&P 500 lost 0.20% to close at 3,783.28, and the Nasdaq Composite slid 0.25% to 11,148.64.

“It’s a snapshot of interruption for the market to ponder how strong the meeting the beyond two days really could end up being,” said Yung-Yu Mama, boss speculation specialist for BMO Abundance The executives. “The market’s making the evaluation that it’s truly going to take a great deal for the Fed to make a timid turn. Indeed, the Shocks number was very welcome, no inquiry concerning that. In any case, that is actually a hint of something larger as far as what the Fed needs to take a gentler tone in fact.”

“There’s some reality crawling into the market and that excitement of a decent number is beginning to blur,” he added.

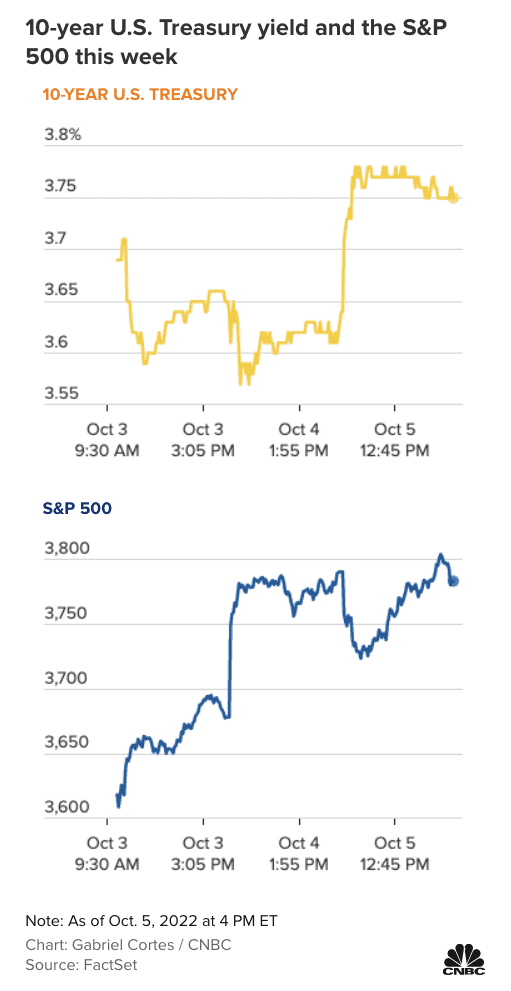

Stocks organized a significant convention before in the week, with the S&P 500 posting its greatest two-day gain starting around 2020, as security yields declined from long term highs. On Wednesday, yields rose forcefully, with the rate on the benchmark 10-year Depository outperforming 3.7% after momentarily dunking underneath 3.6% in the past meeting. That put squeeze on stocks for a significant part of the day.

Confidential payrolls expanded by 208,000, ADP said in its most recent report, besting a Dow Jones gauge. Brokers are looking forward to Friday’s arrival of the nonfarm payrolls report. September’s ISM administrations list likewise came out Wednesday showing strong development.

Some market members puzzled over whether markets have at last evaluated in a base after the sharp decreases in the earlier quarter.

“Q3 profit announcing isn’t excessively far away and it’s certainly in the market brain science that the Q2 income season assisted with settling the business sectors,” Mama said. “There was a ton of cynicism in the market that it had the option to mobilize pretty firmly from for two or three months. The present moment there’s likewise this trust that the income season can balance out the market and perhaps act the hero once more, the way that it did last quarter.”

Leave a comment